Daily Market Analysis 18 Jan 2023 Wednesday

Market Structure : Buy on Dips for Nifty

Nifty turned Bullish with today’s closing. If Nifty crosses the Upper Trendline (See Nifty Hourly Chart), then there is no need to be in bearish mode. Bank Nifty is not yet Bullish. If Weekly Low crosses, then it’s clearly bearish sign. Because these days market closing one day green and the next day red.

Nifty Analysis :

- Nifty opened flat moved higher from the opening.

- Nifty Closed above yesterday’s high which is a Bullish sign.

- If Nifty crosses the Upper Trendline, then there is no need to be in bearish mode.

- Upper Trendline is near to Previous Week’s High

- One more important thing is if tomorrow open’s gapup and if there is any pullback towards this level of 18010 to 17980, then this level will act as support

- If tomorrow open’s gapdown and if there is any pullback towards this level of 18010 to 17980, then this will act as resistance. See the 15 minutes chart.

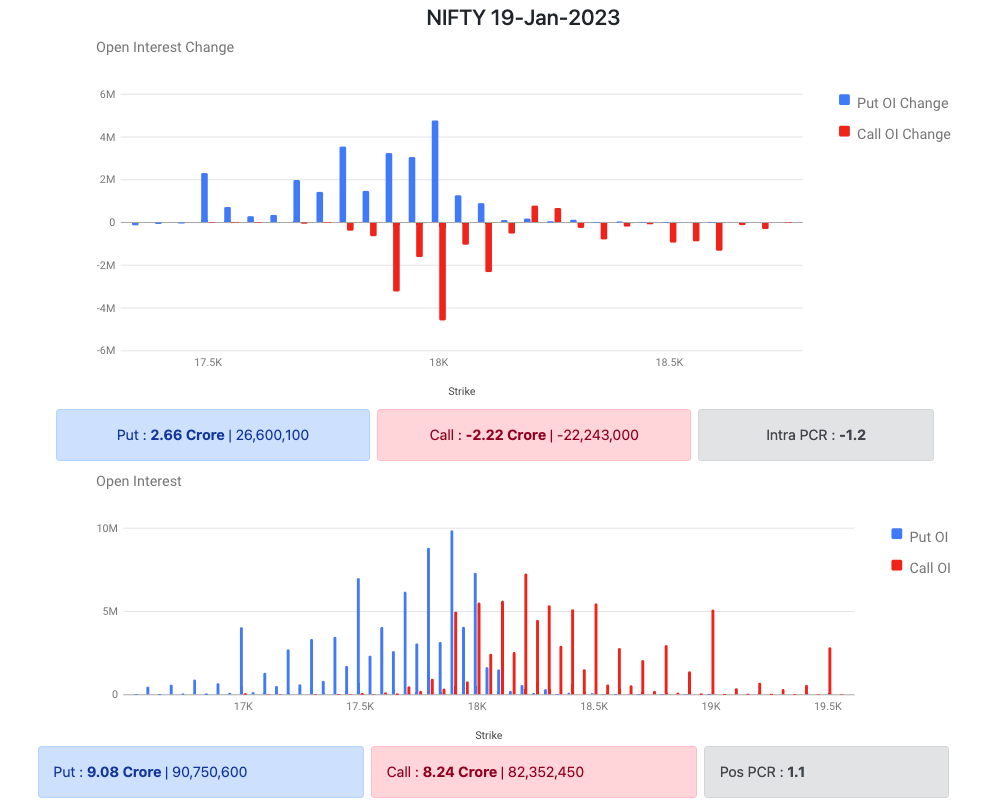

Nifty Weekly Options Data :

- Today is a chaos for option sellers, mainly for who sold calls

- There is a heavy unwinding in calls ranging from 17900 to 18100

- Option Sellers added heavy puts at 18000 and below levels.

- Weekly Options Put Call Ratio is at 1.1

- Option Sellers are still holding more 50 Lakh quantity of 18000 Short Straddles, with slightly higher puts at 18000.

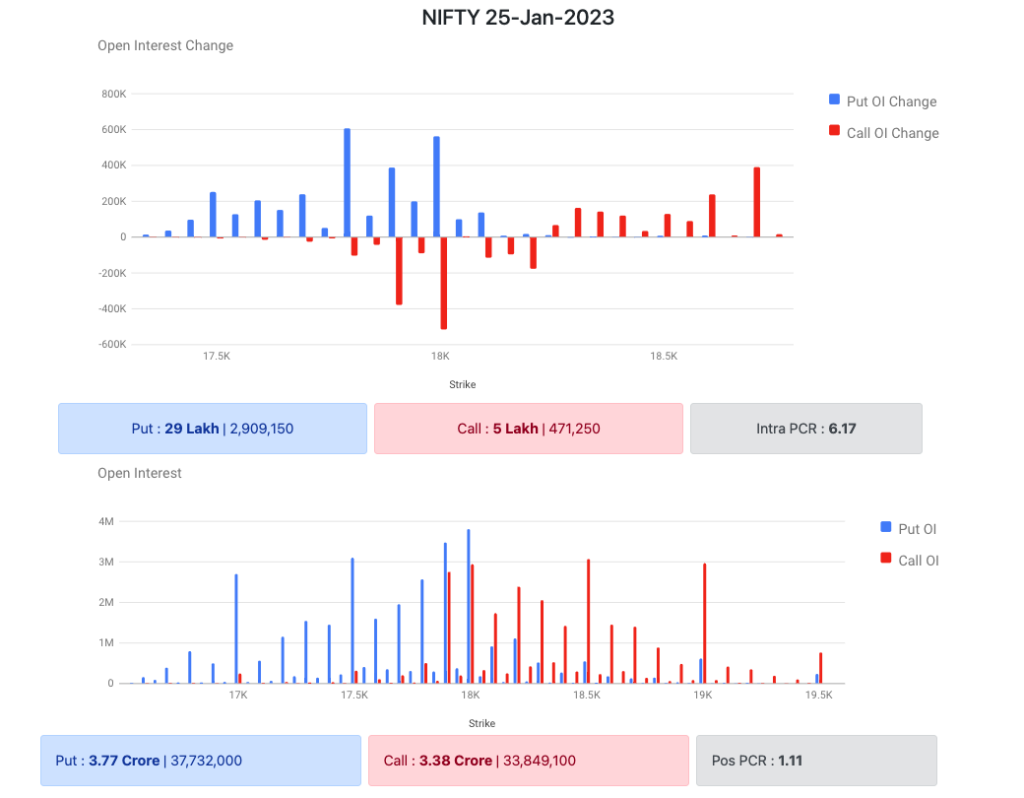

Nifty Monthly Options Data :

- In Monthly options also, Options sellers unwinded 18000 call and 17900 call

- Added Put’s heavily at 18000 and below

- Monthly Options Put Call Ratio is at 1.11

- Options Sellers are holding Short Straddles at 18000 and 17900 levels.

Bank Nifty Analysis :

- Bank Nifty opened slightly gapup and broken the previous day’s low

- And bounced from low point of the day, but not able to cross the Swing High made in Intraday.

- Bank Nifty not able to make new High.

- Bank Nifty’s closing is not that strong.

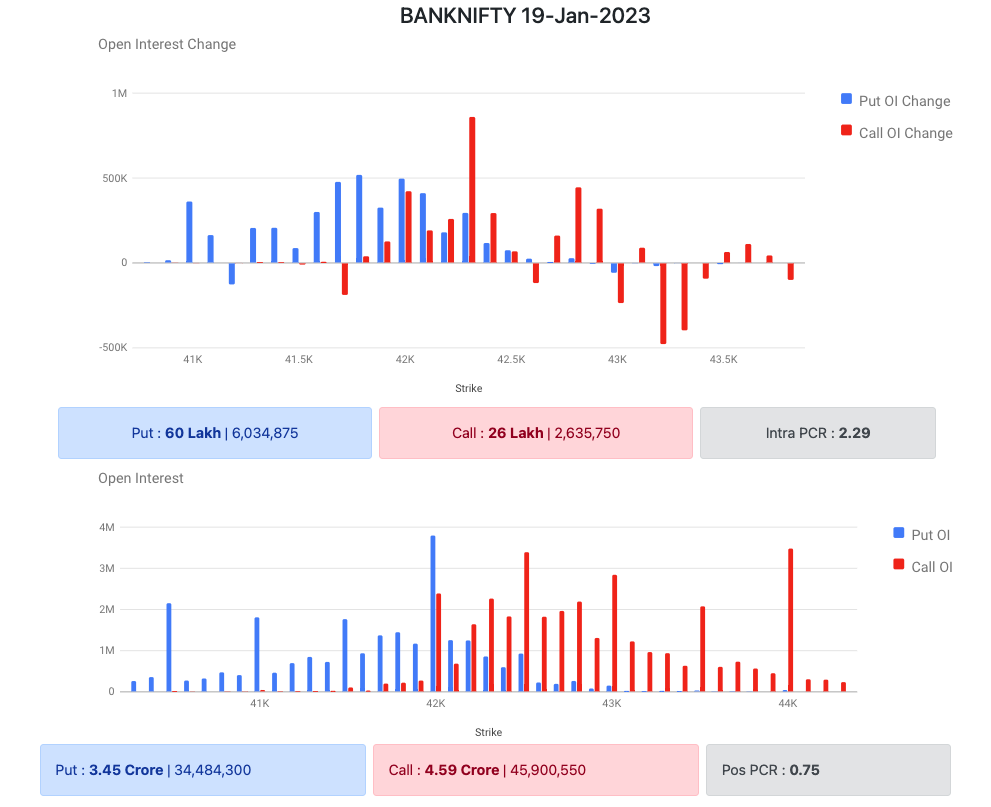

Bank Nifty Weekly Options Data :

- In Weekly Options, heavy puts are written at 42000

- And Calls are written heavily at 42500

- Option Sellers are still holding more 20 Lakh quantity of 42000 Short Straddles, with slightly higher puts at 42000.

- Put Call Ratio is at 0.75

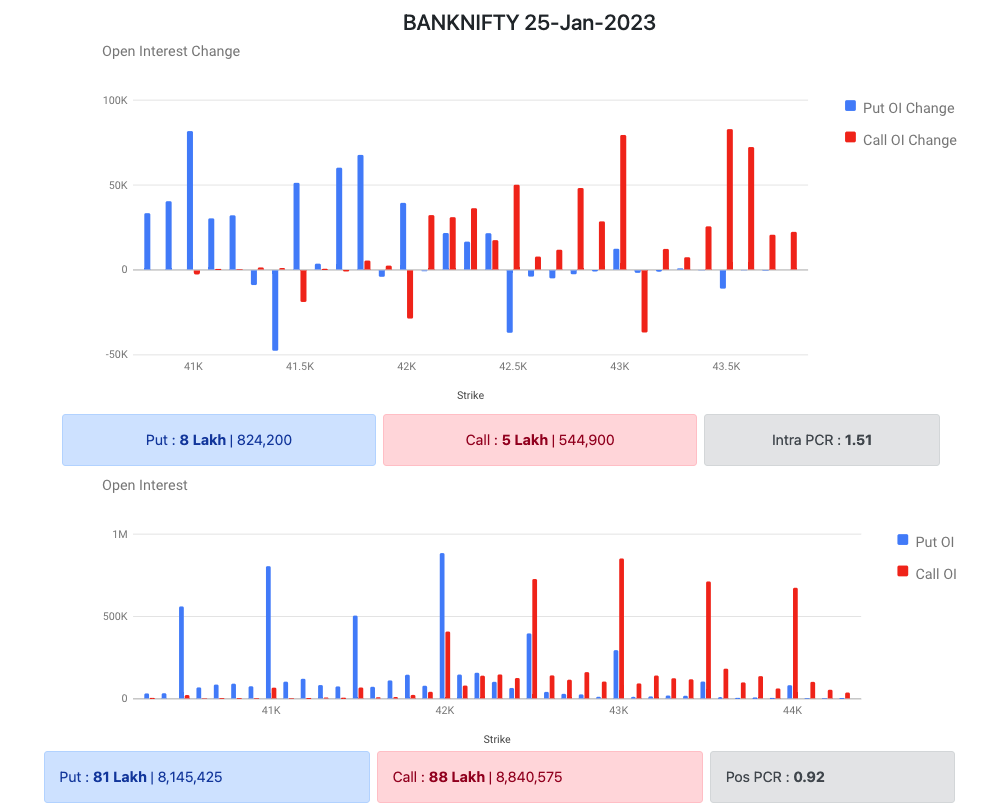

Bank Nifty Monthly Options Data

- In Monthly options, Unwinding is not that significant

- Around 50 thousand Call and Puts are unwinded at every 500 points distance.

Final Thoughts :

- Nifty is Bullish as per today’s closing.

- Bank Nifty is not that Bullish, We may consider it as sideways to bearish as per today’s closing.

- But Nifty and Bank Nifty are still in the Weekly Range.

- For any momentum on one side, Nifty and Bank Nifty should break the Weekly box range.

- Tomorrow in Nifty, 18010 to 17980 level is going to act as important. If gap up above this level, this level will act as Support on a pullback

- If gap down below this level of 18010 to 17980, this level will act as resistance on a pullback.

If you are seeing anything else other than what I’m seeing from this data, post your view below in the comments section.

To get Live Market Price Action updates, follow me on Telegram Binary_Trader_IN

Disclaimer : I’m not a SEBI registered analyst, these are my views only.